Ownership in web3, Rich Dad Poor Dad and economic inequality

The theme of web3 is “ownership.” A lot of diagrams that delineate the difference between web2 and web3 show this distinction: web2 is read/write and web3 is read/write/own. But what does that mean? And who really cares?

To date, “ownership” has been used largely in reference to having a receipt of a jpeg (often of an Ape, no less!), which feels laughably trivial. However, I think that by only looking at today’s version of ownership, we neglect to see the big picture around it.

For me, this big picture around ownership is what gets me so excited about web3, and in order to explain it, I feel it relevant to recall the Rich Dad, Poor Dad argument.

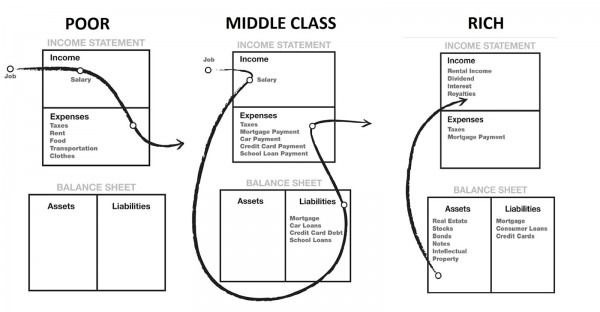

The basic premise of the Rich Dad, Poor Dad argument is that the differentiator between the rich and the middle class/poor is that the “rich dad” has an ability to accumulate wealth through entrepreneurship and savvy investing, while the “poor dad” works hard all his life but never obtains financial security.

Obviously this is a very simplistic explanation of an extremely complicated economic system and is probably one of the many reasons this book has faced tons of criticism. But while I definitely wouldn’t recommend following the advice in it explicitly, I think he is pointing to a core truth in our world today, which is that those who have been able to build wealth through ownership of a capital-growing asset are better off than those who have not. As of 2013, the top 10% of households with the highest wealth in America owned more than 80% of all stocks.

What Rich Dad, Poor Dad doesn’t take into account is the growing inaccessibility of certain asset classes. In Canada, it can take 14 years of full-time work for the average person to save up for a 20% down payment on a home, and parents are increasingly gifting large financial gifts to their children in order for them to own property within a feasible time period, with the national average at $82,000. It is not difficult to see how this can be far out of reach for many, excluding them from the opportunity to gain equity through homeownership, which traditionally has been one of the largest ways many households have grown their wealth.

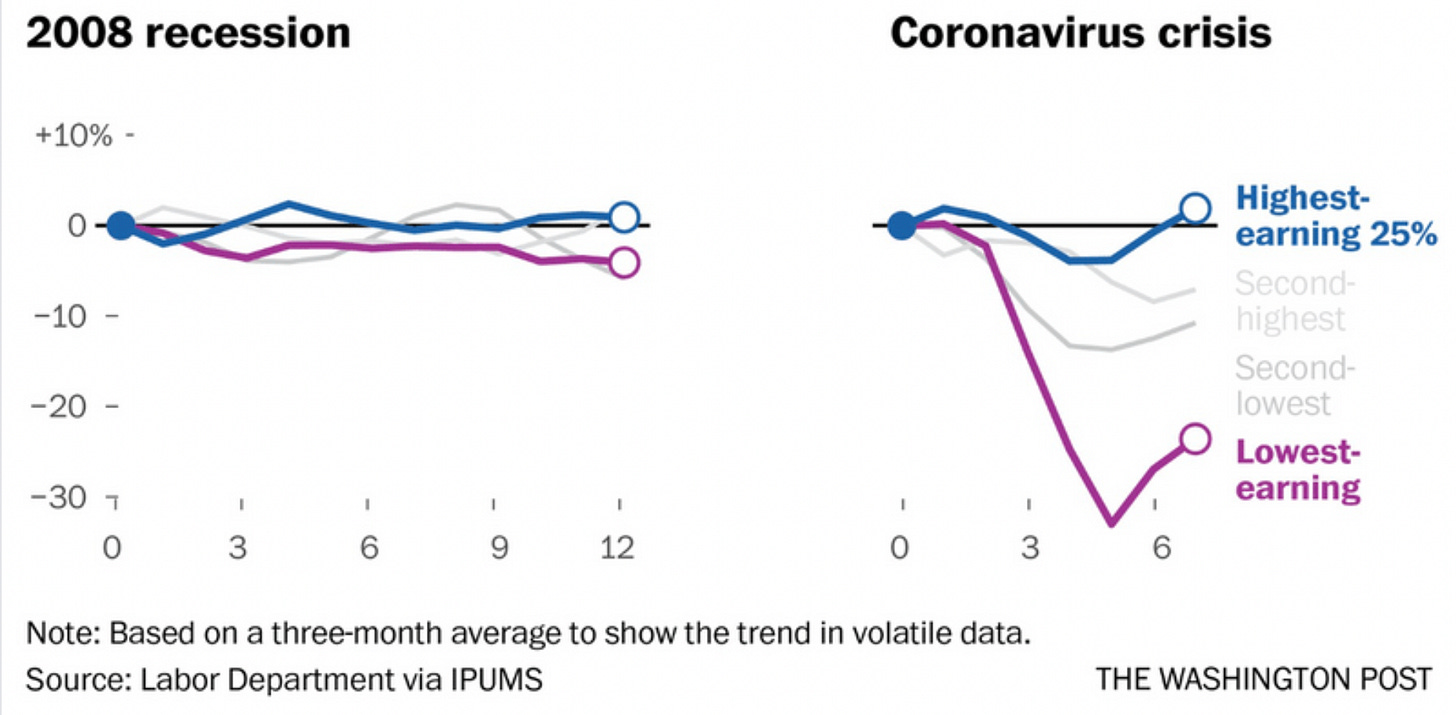

Economic inequality, particularly income and wealth inequality, is at an all time high. The pandemic has shed a light on and exacerbated the ugly truth of society; that we live in a divided world with the gap only getting wider.

It’s important because widening inequality results in higher rates of health and social problems, and lower rates of social goods, population-wide satisfaction and happiness, life expectancy and economic growth. We are already seeing the direct impacts of it through the polarization of our politics and the division of our world views reflected in social media silos and I fear if we don’t address it the repercussions will be far greater than what we’ve already seen.

Okay, that’s a lot of real shit. What do ownership and web3 have to do with all this? In order to change the system, we have to rethink the dynamics at play, particularly the way that individuals access wealth-generating opportunities. Wealth-generation mechanisms often derive from ownership of assets, and the big picture and opportunity in web3 is a world where everyone has an opportunity to own a capital asset that appreciates in value, and therefore, an opportunity to build wealth. As seen in Rich Dad, Poor Dad, this shift is critical to enable financial security, and beyond that, financial freedom.

We are all familiar with the web2 winners, platforms that were able to generate outsized returns for their shareholders through creating marketplaces and exchanging value between various stakeholders (riders <> drivers, delivery people <> consumers, guests <> homes). But imagine if all those stakeholders could also be shareholders? It might be naive to imagine that win-win-win scenarios exist, but I need to believe that they can, and that there’s a better way to build than how we’ve been doing in the past.

There are interesting experiments already at play for different economic models that hint at the possibility of wealth generation through crypto; where individuals are able to fractionally own assets that generate a return for them, where individuals can own a digital asset in a game that enables them to earn income and where being a part of a social movement can result in an increase in value. I suspect we’ll see a lot more in the days and months to come.

If you ask me, the most important thing here is figuring out how to make these models inclusive and accessible for those that have been traditionally excluded from wealth-generating methods. That’s also what’s exciting to me about web3; it’s still relatively new, which means we can (and should) design and build with inclusion in mind from the ground up.

I’m ultimately bullish on web3 because I think this promise of better distributed ownership can unlock a more equitable world. At the end of the day, economic inequality affects all of us and if there’s anything we’ve learned coming out of the past two years, it’s that we need to start thinking towards models that promote collective prosperity and growth. My thoughts are still ever evolving on all this but you can be certain that this is just the beginning.

Way more to come, so watch this space 👀

—

Huge thanks and shout out to the thought leadership I’ve consumed this week that inspired me to write this: Packy’s piece on Ownership and the American Dream, Li Jin's tweet storm on Universal Basic Capital and Roxine’s tweet about access and equity in web3.